Federal vs. private student loans: what’s the difference?

Getting accepted into college is exciting! But… It can also become a little stressful when you see the price tag. For many people, the financial burden of a college education comes down to borrowing money through federal or private student loans.

What is the difference between federal and private student loans? And, which is best for you?

In brief, federal loans are government-funded and offered by the U.S. Department of Education, while a private loan is offered either by a credit union, bank, state agency, or school.

Four types of federal loans

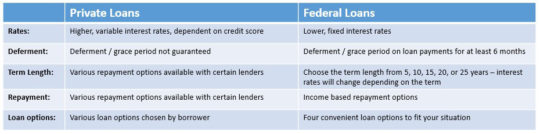

Federal loans offer competitive fixed interest rates, different repayment options, and offer a grace or deferment period in which you do not have to make payments on the loans for six to nine months after graduation. The grace period is nice because it gives the student a chance to acclimate to life after college before they start making payments. Eligibility for federal loans is based on the information provided in the FAFSA.

Direct Subsidized Loans are for undergraduate students and are based on financial need. The school will determine how much you are eligible to borrow, meanwhile, the Department of Education pays the interest while the student is still in school.

Direct Unsubsidized Loans are not based on financial need but are based on the cost of attendance and other financial assistance received. The borrower is responsible for paying the interest on these loans, and if they decide not to pay it until the grace period is over, the interest will accrue on the principal.

To be eligible for these loans, the student must be enrolled at least part-time. These loans are granted to the student per academic year and have a limit to the amount of funding that can be borrowed each year. If awarded one of these loans, the student will see them in their financial aid award package after they complete and submit the FAFSA. These loans will be in the student’s name, who can then choose to accept or deny them.

Direct PLUS Loans are for graduate or professional students, and for parents of undergraduate students who are enrolled at least part-time. If a parent is taking out a Direct Parent PLUS Loan for their child, they will be the primary borrower and the loan will be in their name. There must also be a good credit history and be in good standing. Borrowers are allowed to borrow the cost of attendance minus any other financial aid received.

Direct Federal Perkins Loans are granted to students who have extraordinary financial need and often come with lower interest rates. This loan differs from the others because instead of the Department of Education being the lender, the school is the lender. Payment on this loan will be made to the school itself. Because of this, the amount you are allowed to borrow depends on the amount of funds available at the school, the financial need of the student, and the amount of aid you have already received.

Private loans

Private loans are a way to fund the gaps after all other financial resources have been applied, such as college savings, work-study, scholarships, and federal financial aid. Private loan eligibility is heavily based on credit and are taken out by the student. For students who are just coming into adulthood and might not have a strong enough credit history, they will require a credit-worthy co-signer, such as a parent or family member, to qualify for their private loan.

Here are some helpful questions to ask when choosing a private lender:

- Is the rate variable or fixed?

- What is the floor (how low the rate can go) and the ceiling (how high the rate can go) of the loan?

- Is the rate based on Prime or Libor?

- Is repayment deferred until after graduation?

It’s a smart choice to begin your loan journey with federal aid because private loans typically have higher and variable interest rates, making them more expensive and sometimes riskier. In some cases, the borrower must start repaying the loan while the student is still in school.

Both federal and private student loans offer competitive fixed interest rates, different repayment options, and depending on the loan, a grace or deferment period in which the borrower does not have to make payments on the loans after graduation for 6 months (sometimes 9 months). The grace period gives you a chance to acclimate to life after college before you start making payments. Eligibility for federal loans is based on the information provided in the FAFSA.

Get the answers you need

If you have any questions about student loans, you can speak with a College Access & Repayment Counselor today and learn more about what your future federal or private loan picture looks like! We’d love to answer all of your college financial questions to help you make smart financial decisions for your college education!

Subscribe to The Money Mill to get a link to our free online financial wellness program that’s designed to help you successfully manage your financial life. Plus, you’ll receive emails whenever we publish a new article so you’ll never miss a beat!