How does my FICO® Score represent my creditworthiness?

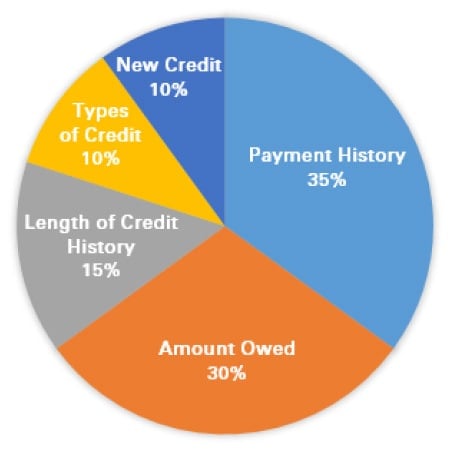

The higher your FICO® Score, the lower credit risk you may be considered. Your score is made up of five key factors. These five factors are payment history, total amount owed, length of credit history, types of credit and new credit. Each factor impacts your credit score by a certain percent.

Payment History

Determined by how well you pay credit accounts. This includes credit cards, mortgage, student loans, car loans and auto leases. Lenders like to see consistent, on-time payments and no delinquencies on all accounts.

Amounts Owed

Considers how much debt you already have and how much of your available credit you use.

Length of Credit History

Considers how long your accounts have been open. A longer credit history provides more payment history information that can be used to determine your FICO® Score.

Types of Credit

Considers the mix of accounts you have, such as credit cards, retail accounts, other lines of credit and installment loans.

New Credit

This represents the frequency of credit inquiries and new account openings.